Our Insurance Diaries

Wiki Article

Things about Medicaid

Table of ContentsThe smart Trick of Car Insurance Quotes That Nobody is DiscussingLittle Known Questions About Renters Insurance.The 10-Minute Rule for Cheap Car InsuranceRenters Insurance for Dummies

You Might Want Disability Insurance Policy Too "In contrast to what many individuals believe, their home or vehicle is not their best property. Instead, it is their capacity to earn an income. Yet, many experts do not insure the possibility of an impairment," said John Barnes, CFP as well as proprietor of My Household Life Insurance Coverage, in an email to The Equilibrium.

The details listed below concentrates on life insurance policy offered to individuals. Term Term Insurance policy is the most basic kind of life insurance. It pays just if fatality happens throughout the term of the policy, which is usually from one to 30 years. Many term plans have nothing else advantage provisions. There are two standard sorts of term life insurance policies: degree term and reducing term.

The cost per $1,000 of benefit rises as the guaranteed person ages, and also it certainly gets extremely high when the guaranteed lives to 80 and also past. The insurer can bill a premium that enhances annually, but that would certainly make it very hard for many people to afford life insurance coverage at innovative ages.

An Unbiased View of Home Insurance

Insurance coverage are created on the principle that although we can not stop unfortunate occasions happening, we can safeguard ourselves financially versus them. There are a large number of various insurance coverage plans available on the marketplace, as well as all insurance companies try to encourage us of the qualities of their specific product. A lot so that it can be difficult to make a decision which insurance coverage plans are really necessary, as well as which ones we can realistically live without.Researchers have actually found that if the main wage income earner were to die their family would just be able to cover their house expenses for just a few months; one in 4 households would have troubles covering their outgoings promptly. Most insurance companies recommend that you secure cover for around 10 times your annual earnings - insurance.

You ought to additionally consider childcare expenses, as well as future college costs if appropriate. There are two main sorts of life insurance coverage plan to choose from: whole life plans, as well as term life plans. You spend for entire life policies up until you die, and also you spend for term life plans for a collection amount of time determined when you get the policy.

Wellness Insurance policy, Wellness insurance policy is one more one of the four primary kinds of insurance policy that specialists advise. A current study revealed that sixty 2 percent of individual insolvencies in the United States in 2007 were as a straight outcome of health issue. A shocking seventy 8 percent of these filers had wellness insurance policy when their ailment started.

Cheap Car Insurance Can Be Fun For Anyone

Costs differ considerably according to your age, your present state of wellness, and also your way of usaa insurance living. Auto Insurance policy, Rule range different nations, however the importance of vehicle insurance coverage remains continuous. Also if it is not a legal demand to take out auto insurance coverage where you live it is extremely suggested that you have some sort of plan in location as you will certainly still have to assume financial obligation when it comes to a mishap.Additionally, your vehicle is commonly among your most beneficial assets, and if it is harmed in a crash you might battle to spend for repairs, or for a replacement. You could also find yourself liable for injuries sustained by your passengers, or the driver of another vehicle, and for damages created to an additional automobile as a result of your carelessness.

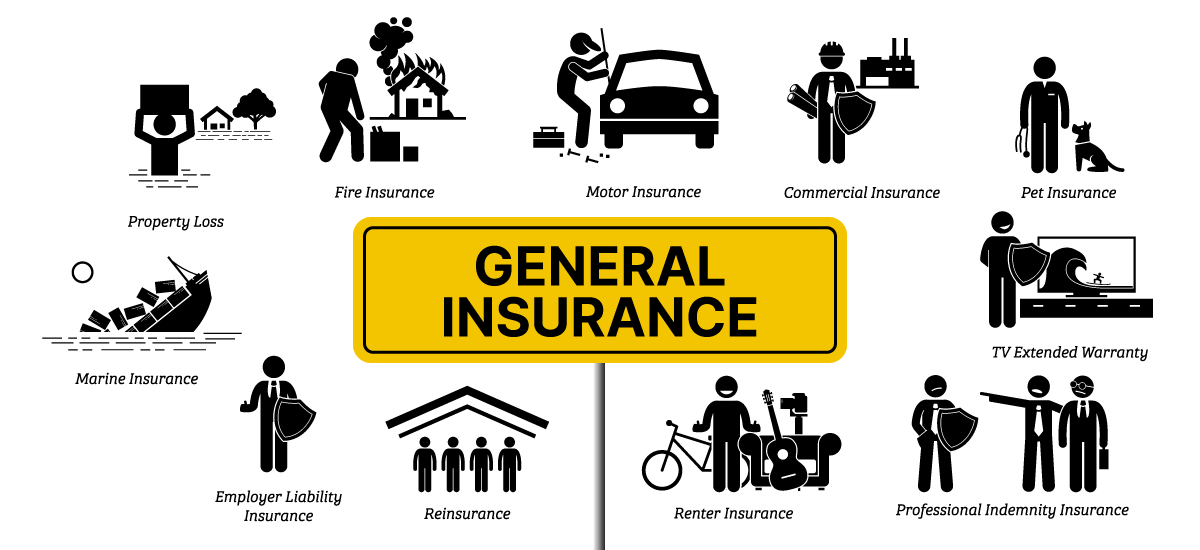

General insurance coverage covers house, your travel, vehicle, and health (non-life assets) from fire, floodings, crashes, synthetic catastrophes, and burglary. Different kinds of general insurance coverage consist of electric motor insurance, health and wellness insurance coverage, travel insurance policy, and also house insurance. A basic insurance policy pays for the losses that are incurred by the insured throughout the period of the policy.

Check out on to recognize even more concerning them: As the house is a beneficial possession, it is necessary to protect your residence with a proper. Residence and family insurance policy safeguard your home and also the things in it. A house insurance policy essentially covers synthetic and also all-natural conditions that might result in damage or loss.

An Unbiased View of Health Insurance

When your car is accountable for a mishap, third-party insurance takes treatment of the injury triggered to a third-party. It is also crucial to note that third-party electric motor insurance is required as per the Motor Autos Act, 1988.

A hospitalization expenditures up to the amount guaranteed. When it concerns medical insurance, one can choose a standalone wellness policy or a household drifter plan that provides insurance coverage for all household members. Life insurance coverage provides coverage for your life. If a circumstance happens in which the policyholder has a sudden death within the term of the policy, after that the candidate obtains the amount assured by the insurance provider.

Life insurance policy is various from general insurance on numerous specifications: is a short-term contract whereas company website life insurance policy is a long-lasting agreement. When it comes to life insurance policy, the benefits and also the sum ensured is paid on the maturation of the policy or in case of the policy owner's fatality.

They are nevertheless not mandatory to have. The general insurance policy cover that is obligatory is third-party obligation auto insurance policy. This is the minimal coverage that a car ought to have prior to they can our website layer on Indian roads. Each as well as every sort of basic insurance policy cover features an aim, to provide coverage for a specific aspect.

Report this wiki page